Because of the limited space available on the.

A floor broker is a person at the nasdaq with a trading license who represents orders on the floor.

T f a floor broker is a person at the nasdaq with a trading license who represents orders on the floor.

The owner of a trading license who trades on the floor of the nyse for his or her personal account is called a n.

The nasdaq on the other hand does not have a physical trading floor at all.

Deals with the larger orders on nyse may trade with another broker or specialist super display book system.

Limit order you placed an order to purchase stock where you specified the maximum price you were willing to pay.

A floor broker is a person with a trading license who executes orders on the nasdaq exchange floor true a firm can either pay its earnings to its investors or it can keep them and reinvest them.

An electronic network that transmits orders directly to the trading floor.

Level 3 data available online for easy access by all investors.

You placed an order to purchase stock where you specified the maximum price you were willing to pay.

This type of order is known as a.

Multiple market maker system c.

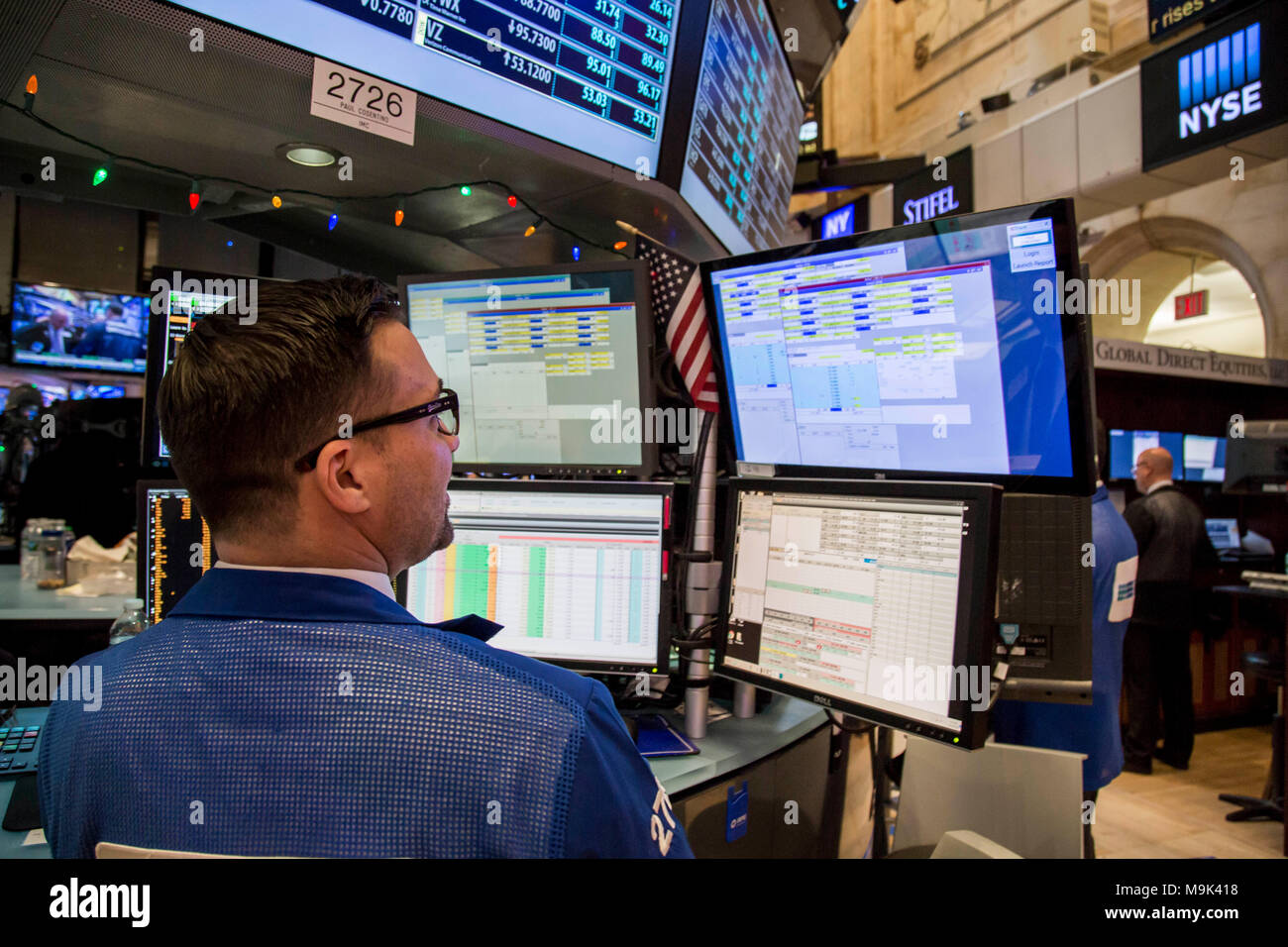

A person at nyse with a trading license who represents orders on the floor balancing speed and price to gest the best execution.

A floor broker also known as a pit broker is an independent member of an exchange who is authorized to execute trades on the exchange floor.

To put it simply a floor broker is someone who represents client orders at the point of sale on the nyse floor our source explained.

Trading in the crowd b.

At both telecommunications centers trading takes place directly between investors seeking to buy or sell and market.

Both floor and commission brokers.

A single designated market maker for each listed stock.

Almost all nyse floor brokers trade on an agency basis.

A person who executes customer orders to buy and sell securities on the floor of the nyse is called a.

:max_bytes(150000):strip_icc()/GettyImages-1195603075-7e8dc700af47458e9b4f03a91c1397d8.jpg)